Common Mistakes With Grandparent Owned 529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are

529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are not considered an asset when applying for financial aid, distributions from 529 accounts on behalf of the beneficiary are considered income of the account beneficiary in the year that the disbursement occurs from 529 account.

For example, assume the grandchild receives $20,000 in financial aid in their freshman year but there is still a $10,000 balance due to attend college. The grandparents distribute $10,000 from the 529 account that they own for the benefit of the grandchild. When the parents apply for the financial aid package in the student’s Junior year, they $10,000 529 disbursement that took place in the freshman year will need to be reports as income of the student on the FASFA application. That could completely destroy their financial aid package since 50% of the student’s income counts against the financial aid package.

Remember, the FASFA application now looks back two years instead of one for income purposes. To avoid this situation, the grandparents should not distribute any money from the grandchild’s 529 account until the spring semester of their sophomore year.

Don’t setup UGMA or UTMA accounts

UGMA a stands for Uniform Gift to Minors Act. UTMA stands for Uniform Transfer to Minors Act. Different names but the accounts work in a similar fashion.

If there is a chance that the student may qualify for financial support from either a public or private institution, these accounts can significantly reduce the financial award. The types of accounts are considered an asset of the child not the grandparent. When an asset is titled in the child’s name, approximately 20% of the account balance will count against their financial aid package. For this reason, it is often more beneficial to establish a 529 account which is considered an asset of the grandparent and can be invisible for financial aid purposes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

5 Options For Money Left Over In College 529 Plans

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

If your child graduates from college and you are fortunate enough to still have a balance in their 529 college savings account, what are your options for the remaining balance? There are basically 5 options for the money left over in college 529 plans.

Advanced degree for child

If after the completion of an undergraduate degree, your child plans to continue on to earn a master's degree, law school, or medical school, you can use the remaining balance toward their advanced degree.

Transfer the balance to another child

If you have another child that is currently in college or a younger child that will be attending college at some point, you can change the beneficiary on that account to one of your other children. There is no limit on the number of 529 accounts that can be assigned to a single beneficiary.

Take the cash

When you make withdrawals from 529 accounts for reasons that are not classified as a "qualified education expenses", the earnings portion of the distribution is subject to income taxation and a 10% penalty. Again, only the earnings are subject to taxation and the penalty, your cost basis in the account is not. For example, if my child finishes college and there is $5,000 remaining in their 529 account, I can call the 529 provider and ask them what my cost basis is in the account. If they tell me my cost basis is $4,000 that means that the income taxation and 10% penalty will only apply to $1,000. The rest of the account is withdrawn tax and penalty free.

Reserve the account for a future grandchild

Once your child graduates from college, you can change the beneficiary on the account to yourself. By doing so the account will continue to grow and once your first grandchild is born, you can change the beneficiary on that account over to the grandchild.

Reserve the account for yourself or spouse

If you think it's possible that at some point in the future you or your wife may go back to school for a different degree or advanced degree, you assign yourself as the beneficiary of the account and then use the account balance to pay for that future degree.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Tax Deductions For College Savings

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it

Did you know that if you are resident of New York State there are tax deductions waiting for you in the form of a college savings account? As a resident of NYS you are allowed to take a NYS tax deduction for contributions to a NYS 529 Plan up to $5,000 for a single filer or $10,000 for married filing joint. These limits are hard dollar thresholds so it does not matter how many kids or grandchildren you have.

529 Accounts

529 accounts are one of the most tax efficient ways to save for college. You receive a state income tax deduction for contributions and all of the earnings are withdrawn tax free if used for a qualified education expense. These accounts can only be used for a college degree but they can be used toward an associate’s degree, bachelor’s degree, masters, or doctorate. You can name whoever you want as a beneficiary including yourself. More commonly, we see parents set these accounts up for their children or grandparents for the grandchildren.

Can they go to college in any state?

If you setup a NYS 529 account, the beneficiary can go to college anywhere in the United States. It’s not limited to just colleges in New York. As the owner of the account you can change the beneficiary on the account whenever you choose or close the account at your discretion.

What if they don't go to college?

The question we usually get is “what if they don’t go to college?” If you have a 529 account for a beneficiary that does not end up going to college you have a few choices. You can change the beneficiary listed on the account to another child or even yourself. You can also decide to just liquidate the account and receive a check. If the account is closed and the balance is not used for a qualified college expense then you as the owner receive your contributions back tax and penalty free. However, you will pay ordinary income tax and a 10% penalty on just the earnings portion of the account.

What if my child receives a scholarship?

There is a special withdrawal exception for scholarship awards. They do not want to penalize you because the beneficiary did well in high school or is a star athlete so they allow you to make a withdrawal from the 529 account equal to the amount of the scholarship. You receive your contributions tax free, you pay ordinary income tax on the earnings, but you avoid the 10% penalty for not using the account toward a qualified college expense.

Don't make this mistake.............

We often see individuals making the mistake of setting up a 529 account in another state because “their advisor told them to do so”. You are completely missing out on a good size NYS tax deduction because you only get credit for NYS 529 contributions. A little-known fact is that you can rollover a 529 with another state into a NYS 529 account and that rollover amount will count toward your $5,000 / $10,000 deduction limit for the year. If a client has $30,000 in a 529 account outside of NYS we typically advise them to roll it over in $10,000 pieces over a three year period to maximize the $10,000 per year NYS tax deduction.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

NY Free Tuition - Facts and Myths

On April 9th New York State became the first state to adopt a free tuition program for public schools. The program was named the “Excelsior Scholarship” and it will take effect the 2017 – 2018 school year. It has left people with a lot of unanswered questions

On April 9th New York State became the first state to adopt a free tuition program for public schools. The program was named the “Excelsior Scholarship” and it will take effect the 2017 – 2018 school year. It has left people with a lot of unanswered questions

Do I qualify?

How much does it cover?

What’s the catch?

Can I move my finances around to qualify for the program?

This article was written to help people better understand some of the facts and myths surrounding the NY Free Tuition Program.

Who qualifies for free tuition?

It’s based on the student’s household income and it phases in over a three year period:

2017: $100,000

2018: $110,000

2019: $125,000

MYTH #1: “If I reduce my household income in 2017 to get under the $100,000 threshold, it will help my child qualify for the free tuition program for the 2017 – 2018 school year.” WRONG. The income “determination year” is the same determination year that is used for FASFA filing. FASFA changed the rules in 2016 to look back two years instead of one for purposes of qualifying for financial aid. Those same rules will apply to the NY Free Tuition Program. So for the 2017 – 2018 school year, the $100,000 free tuition threshold will apply to your income in 2015.

MYTH #2: “If I make contributions to my retirement plan it will help reduce my household income to qualify for the free tuition program.” WRONG. Again, the free tuition program will use the same income calculation that is used in the FASFA process so it is not as simple as just looking at the bottom line of your tax return. For FASFA, any contributions that are made to retirement plans are ADDED back into your income for purposes of determining your income for that “determination year”. So making big contributions to a retirement plan will not help you qualify for free tuition.

What does it cover?

MYTH #3: “As long as my income is below the income threshold my kids (or I) will go to college for free.” DEFINE “FREE”. The Excelsior Scholarship covers JUST tuition. It does not cover books, room and board, transportation, or other costs associated with going to college. Annual tuition at a four-year SUNY college is currently $6,470. Here are the total fees obtained directly from the SUNY.edu website:

Tuition: $6,470 Covered

Student Fee: $1,640 Not Covered

Room & Board: $12,590 Not Covered

Books & Supplies: $1,340 Not Covered

Personal Expenses: $1,560 Not Covered

Transportation: $1,080 Not Covered

Total Costs $24,680

When you do the math for a student living on campus, the “Free” tuition program only covers 26% of the total cost of attending college.

What’s the catch?

There are actually a few:

CATCH #1: After the student graduates from college they have to LIVE and WORK in NYS for at least the number of years that the free tuition was awarded to the student OTHERWISE the “free tuition” turns into a LOAN that will be required to be paid back. Example: A student receives the free tuition for four years, works in New York for two years, and then moves to Massachusetts for a new job. That student will have to pay back two years of the free tuition.

CATCH #2: The student must maintain a specified GPA or higher otherwise the “free tuition” turns into a LOAN. However, the GPA threshold has yet to be released.

CATCH #3: It’s only for FULL TIME students earning at least 30 credit hours every academic year. This could be a challenge for students that have to work in order to put themselves through college.

CATCH #4: This is a “Last Dollar Program” meaning that students have to go through the FASFA process and apply for all other types of financial aid and grants that are available before the Free Tuition Program kicks in.

CATCH #5: The free tuition program is only available for two and four year degrees obtained within that two or four year period of time. If it take the student five years to obtain their four year bachelor’s degree, only four of the five years is covered under the free tuition program.

Summary

There are many common misunderstandings associated with the NYS Free Tuition Program. In general, it’s our view that this new program is only going to make college “more affordable” for a small sliver of students were not previously covered under the traditional FASFA based financial aid. Given the rising cost of college and the complexity of the financial aid process it has never been more important than it is now for individuals to work with a professional that have an in depth knowledge of the financial aid process and college savings strategies to help better prepare your household for the expenses associated with paying for college.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Need to Know College Savings Strategies

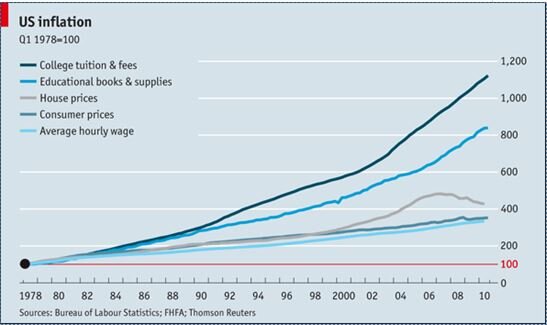

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control.

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.