College Savings Account Options

There are a lot of different types of accounts that you can use to save for college. But, certain accounts have advantages over others such as:

· Tax deductions for contributions

· Tax free accumulation and withdrawal

· The impact on college financial aid

· Who has control over the account

· Accumulation rate

The types of college savings account that I will be covering in this article are:

· 529 accounts

· Coverdell accounts (also know as ESA’s)

· UTMA / UGMA accounts

· Brokerage Accounts

· Savings Accounts

To make it easy to compare and contrast each option, I will have a grading table at the beginning of each section that will provide you with some general information on each type of account, as well as my overall grade on the effectiveness of each college saving option.

529 Plans

I’ll start with my favorite which are 529 College Savings Plan accounts. As a Financial Planner, I tend to favor 529 accounts as primary college savings vehicles due to the tax advantages associated with them. Many states offer state income tax deductions for contributions up to specific dollar amounts, so there is an immediate tax benefit. For example, New York provides a state tax deduction for up to $5,000 for single filers, and $10,000 for joint filers for contributions to NYS 529 accounts year. There is no income limitation for contributing to these accounts.

NOTE: Every now and then I come across individuals that have 529 accounts outside of their home state and they could be missing out on state tax deductions.

However, the bigger tax benefit is that fact that all of the investment returns generated by these accounts can be withdrawn tax free, as long as they are used for a qualified college expense. For example, if you deposit $5K into a 529 account when your child is 2 years old, and it grows to $15,000 by the time they go to college, and you use the account to pay qualified expenses, you do not pay tax on any of the $15,000 that is withdrawn. That is huge!! With many of the other college savings options like UTMA or brokerage accounts, you have to pay tax on the gains.

There is also a control advantage, in that the parent, grandparent, or whoever establishes the accounts has full control as to when and how much is distributed from the account. This is unlike UTMA / UGMA accounts, where once the child reaches a certain age, the child can do whatever they want with the account without the account owner’s consent.

A 529 account does count against the financial aid calculation, but it is a minimal impact in most cases. Since these accounts are typically owned by the parents, in the FAFSA formula, 5.6% of the balance would count against the financial aid reward. So, if you have a $50,000 balance in a 529 account, it would only set you back $2,800 per year in financial aid.

I gave these account an “A” for an accumulation rating because they have a lot of investment option available, and account owners can be as aggressive or conservative as they would like with these accounts. Many states also offer “age based portfolios” where the account is allocated based on the age of the child, and when the will turn 18. These portfolios automatically become more conservative as they get closer to the college start date.

The contributions limits to these accounts are also very high. Lifetime contributions can total $400,000 or more (depending on your state) per beneficiary.

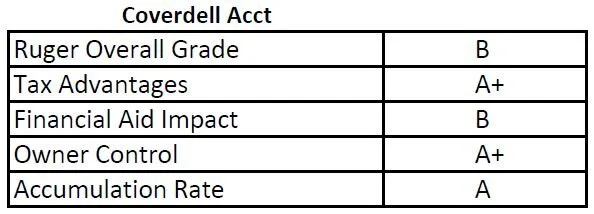

Coverdell Accounts (Education Savings Accounts)

Coverdell accounts have some of the benefits associated with 529 accounts, but there are contribution and income restrictions associated with these types of accounts. First, as of 2021, only taxpayers with adjusted gross income below $110,000 for single filers and $220,000 for joint filers are eligible to contribute to Coverdell accounts.

The other main limiting factor is the contribution limits. You are limited to a $2,000 maximum contribution each year until the beneficiary’s 18th birthday. Given the rising cost of college, it is difficult to accumulate enough in these accounts to reach the college savings goals for many families. Similar to 529 accounts, these accounts are counted as an asset of the parents for purposes of financial aid.

The one advantage these accounts have over 529 accounts is that the balance can be used without limitations for qualified expenses to an elementary or secondary public, private, or religious school. The federal rules recently changed for 529 accounts allowing these types of qualified withdrawal, but they are limited to $10,000 and depending on the state you live in, the state may not recognize these as qualified withdrawals from a 529 account.

If there is money left over in these Coverdell account, they also have to be liquidated by the time the beneficiary of the account turns age 30. 529 accounts do not have this restriction.

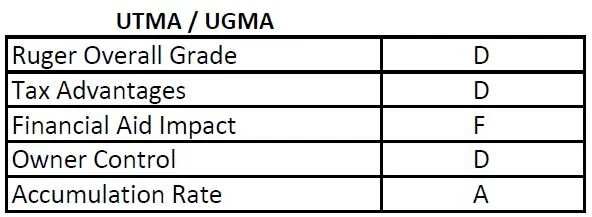

UTMA & UGMA Accounts

UGMA & UTMA accounts get the lowest overall grade from me. With these accounts, the child is technically the owner of the account. While the child is a minor, the parent is often assigned as the custodian of the account. But once the child reaches legal age, which can be 18, 19, or 21, depending on the state you live in, the child is then awarded full control over the account. This can be a problem when your child decides at age 18 that buying a Porsche is a better idea than spending that money on college tuition.

Also, because these accounts are technically owned by the child, they are a wrecking ball for the financial aid calculation. As I mentioned before, when it is an asset of the parent, 5.6% of the balance counts against financial aid, but when it is an asset of the child, 20% of the account balance counts against financial aid.

There are no special tax benefits associated with UTMA and UGMA accounts. No tax deductions for contributions and the child pays taxes on the gains.

Unlike 529 and Coverdell accounts, where you can change the beneficiary list on the account, with UTMA and UGMA accounts, the beneficiary named on the account cannot be changed.

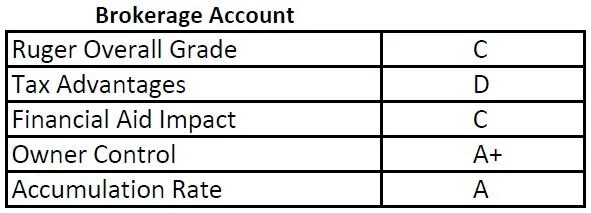

Brokerage Accounts

Parents can use brokerage accounts to accumulate money for college instead of the cash sitting in their checking account earning 0.25% per year. The disadvantage is the parents have to pay tax on all of the investment gains in the account once they liquidate them to pay for college. If the parents are in a higher tax bracket, they could lose up to 40%+ of those gains to taxes versus the 529 accounts where no taxes are paid on the appreciation. But, it also has the double whammy that if the parents realize capital gains from the liquidation, their income will be higher in the FAFSA calculation two years from now.

Sometimes, a brokerage account can complement a 529 account as part of a comprehensive college savings strategy. Many parents do not want to risk “over funding” a 529 account, so once the 529 accounts have hit a comfortable level, they will begin contributing the rest of the college savings to a brokerage account to maintain flexibility.

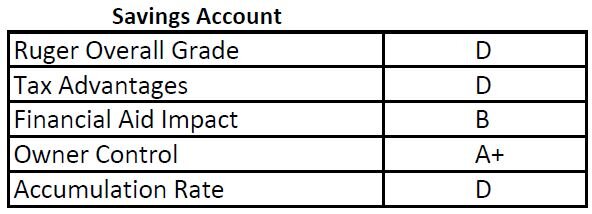

Savings Accounts

The pros and cons of a savings account owned by the parent or guardian of the child will have similar pros and cons of a brokerage account with one big drawback. Last I checked, most savings accounts were earning under 1% in interest. The cost of college since 1982 has increased by 6% per year (JP Morgan College Planning Essentials 2021). If the cost of college is going up by 6% per year, and your savings is only earning 1% per year, even though the balance in your savings account did not drop, you are losing ground to the tune of 5% PER YEAR. By having your college savings accounts invested in a 529, Coverdell, or brokerage account, it will at least provide you with the opportunity to keep pace with or exceed the inflation rate of college costs.

Can The Cost of College Keep Rising?

Let’s say the cost of attending college keeps rising at 6% per year, and you have a 2-year-old child that you want to send to state school which may cost $25,000 per year today. By the time they turn 18, it would cost $67,000 PER YEAR, times 4 years of college, which is $268,000 for a bachelor’s degree! The response I usually get when people hear these number is “there is no way that they can allow that to happen!!”. People were saying that 10 years ago, and guess what? It happened. This is what makes having a solid college savings strategy so important for your overall financial plan.

NOTE: As Financial Planners, we are seeing a lot more retirees carry mortgages and HELOC’s into retirement and the reason is usually “I helped the kids pay for college”.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Divorce: Make Sure You Address The College Savings Accounts

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences

The most common types of college savings accounts are 529 accounts, UGMA, and UTMA accounts. When getting divorce it’s very important to understand who the actual owner is of these accounts and who has legal rights to access the money in those accounts. Not addressing these accounts in the divorce agreement can lead to dire consequences for your children if your ex-spouse drains the college savings accounts for their own personal expenses.

UGMA or UTMA Accounts

The owner of these types of accounts is the child. However, since a child is a minor there is a custodian assigned to the account, typically a parent, that oversees the assets until the child reaches age 21. The custodian has control over when withdraws are made as long as it could be proven that the withdrawals being made a directly benefiting the child. This can include school clothes, buying them a car at age 16, or buying them a computer. It’s important to understand that withdraws can be made for purposes other than paying for college which might be what the account was intended for. You typically want to have your attorney include language in the divorce agreement that addresses what these account can and can not be used for. Once the child reaches the age of majority, age 21, the custodian is removed, and the child has full control over the account.

529 accounts

When it comes to divorce, pay close attention to 529 accounts. Unlike a UGMA or UTMA accounts that are required to be used for the benefit of the child, a 529 account does not have this requirement. The owner of the account has complete control over the 529 account even though the child is listed as the beneficiary. We have seen instances where a couple gets divorced and they wrongly assume that the 529 account owned by one of the spouses has to be used for college. As soon as the divorce is finalized, the ex-spouse that owns the account then drains the 529 account and uses the cash in the account to pay legal fees or other personal expenses. If the divorce agreement did not speak to the use of the 529 account, there’s very little you can do since it’s technically considered an asset of the parent.

Divorce agreements can address these college saving accounts in a number of way. For example, it could state that the full balance has to be used for college before out-of-pocket expenses are incurred by either parent. It could state a fixed dollar amount that has to be withdrawn out of the 529 account each year with any additional expenses being split between the parents. There is no single correct way to address the withdraw strategies for these college savings accounts. It is really dependent on the financial circumstances of you and your ex spouse and the plan for paying for college for your children.

With 529 accounts there is also the additional issue of “what if the child decides not to go to college?” The divorce agreement should address what happens to that 529 account. Is the account balance move to a younger sibling? Is the balance distributed to the child at a certain age? Or will the assets be distributed 50-50 between the two parents?

Is for these reason that you should make sure that your divorce agreement includes specific language that applies to the use of the college savings account for your children

For more information on college savings account, click on the hyperlink below:

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.