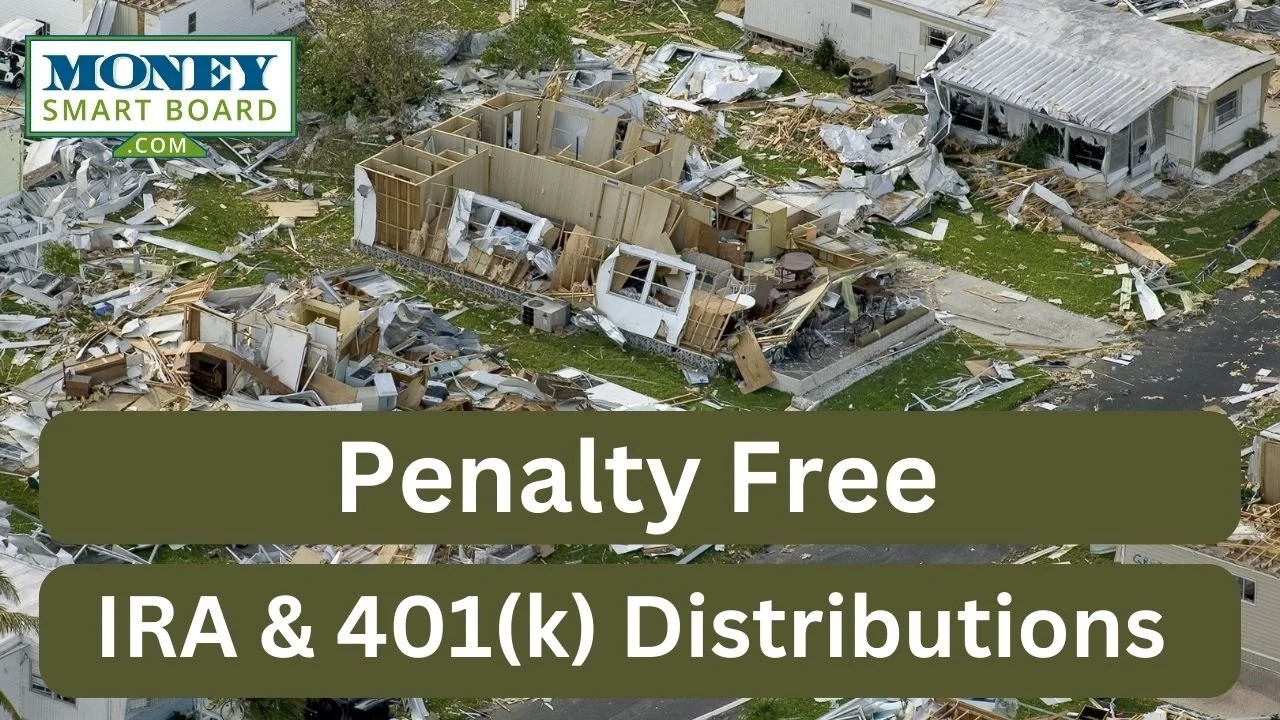

Federal Disaster Area Penalty-Free IRA & 401(k) Distribution and Loan Options

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Individuals who experience a hurricane, flood, wildfire, earthquake, or other type of natural disaster may be eligible to request a Qualified Disaster Recovery Distribution or loan from their 401(k) or IRA to assist financially with the recovery process. The passing of the Secure Act 2.0 opened up new distribution and loan options for individuals whose primary residence is in an area that has been officially declared a “Federal Disaster” area.

Qualified Disaster Recovery Distributions (QDRD)

In December 2022, the passing of the Secure Act 2.0 made permanent, a distribution option within both 401(K) plans and IRAs, that allows individuals to distribute up to $22,000 from either a 401(k) or IRA, and that distribution is exempt from the 10% early withdrawal penalty. Typically, when an individual is under the age of 59½ and takes a distribution from a 401(K) or IRA, the distribution is subject to both taxes and a 10% early withdrawal penalty.

For an individual, it’s an aggregate of $22,000 between both their 401(k) and IRA accounts, meaning, they can’t distribute $22,000 from their IRA and then another $22,000 from their 401(k), and avoid the 10% penalty on the full $44,000.

If you are married, if each spouse has an IRA and/or 401(k) plan, each spouse would be eligible to process a qualified disaster recovery distribution for the full $22,000 and avoid the 10% penalty on the combined $44,000.

Taxation of Federal Disaster Distributions

Even though these distributions are exempt from the 10% early withdrawal penalty, they are still subject to federal and state income taxes, but the taxpayer has two options:

The taxpayer can elect to include the full amount of the distribution as taxable income in the year that the QDRD takes place; OR

The taxpayer can elect to spread the taxable amount evenly over a 3-year period that begins the year that distribution occurred.

Here is an example of the tax options. Tim is age 40, he lives in Florida, and his area experiences a hurricane. Shortly after the hurricane, the area where Tim’s house is located was officially declared a Federal Disaster Area by FEMA. To help pay for the damage to his primary residence, Tim processes a $12,000 qualified disaster recovery distribution from his Traditional IRA. Tim would not have to pay the 10% early withdrawal penalty due to the QDRD exception, but he would be required to pay federal income tax on the full $12,000. He has the option to either report the full $12,000 on his tax return in the year the distribution took place, or he could elect to spread the $12,000 tax liability over the next 3 years, reporting $4,000 in additional taxable income each year beginning the year that the QDRD took place.

Repayment Option

If an individual completes a disaster recovery distribution from their 401(k) or IRA, they have the option to repay the money to the account within 3 years of the date of the distribution. This allows them to recoup the taxes paid on the distribution by filing an amended tax return(s) for the year or years that the tax liability was reported from the QDRD.

180 Day & Financial Loss Requirement

To make an individual eligible to request a QDRD, not only does their primary residence have to be located within a Federal Disaster area, but they also need to request the QDRD within 180 days of the disaster, and they must have sustained an economic loss on account of the disaster.

QDRD Are Optional Provisions Within 401(k) Plans

If you have a 401(k) plan, a Qualified Disaster Recovery Distribution is an OPTIONAL provision that must be adopted by the plan sponsor of a 401(k) to provide their employees with this distribution option. In other words, your employer is not required to allow these disaster recovery distributions, they have to adopt them. If you live in an area that is declared a federal disaster area and your 401(k) plan does not allow this type of distribution option, you can contact your employer and request that it be added to the plan. Many companies may not be aware that this is a voluntary distribution option that can be added to their plan.

If you have an IRA, as long as you meet the criteria for a QDRD, you are eligible to request this type of distribution.

If you have a 401(k) plan with a former employer and their plan does not allow QDRD, you may be able to rollover the balance in the 401(k) to an IRA, and then request the QDRD from the IRA.

What Changed?

Prior to the passing of Secure Act 2.0, Congress had to authorize these Qualified Disaster Recovery Distributions for each disaster. Section 331 of the Secure Act 2.0 made these QDRDs permanent.

However, one drawback is in the past, these qualified disaster recovery distributions were historically allowed up to $100,000, but the new tax law lowered the maximum QDRD amount to only $22,000.

$100,000 401(k) Loan for Disaster Relief

In addition to the qualified disaster recovery distributions, Secure Act 2.0, also allows plan participants in 401(K) plans to request loans up to the LESSER of $100,000 or 100% of their vested balance in the plan.

Typically, when plan participants request loans from a 401(K) plan, the maximum amount is the LESSER of $50,000 or 50% of their vested balance in the plan. Secure Act 2.0, doubled that amount. The eligibility requirements to receive a disaster recovery 401(k) loan are the same as the eligibility requirements for a Qualified Disaster Recovery Distribution.

In addition to the higher loan limit, plan participants eligible for a 401(K) qualified disaster recovery loan, are also allowed to delay the start date of their loan payments for up to 1 year from the loan processing date. Normally when a 401(K) loan is requested, loan payments begin immediately.

These loans are still subject to the 5-year duration limit, but with the optional 12-month delay in the loan payment start date, the maximum duration of these qualified disaster loans is technically 6 years.

401(K) Loans Are an Optional Provision

Similar to Qualified Disaster Recovery Distributions, 401(k) loans are an optional provision that must be adopted by the plan sponsor of a 401(k) plan. Some plans allow plan participants to take loans while others do not, so the ability to take these disaster recovery loans will vary from plan to plan.

Loans Are Only Available In Qualified Retirement Plans

The $100,000 loan option is only available for Qualified Retirement Plans such as 401(k) and 403(b) plans. IRAs do not provide a loan option. The $22,000 Qualified Disaster Recovery Distribution is the only option for IRAs unless Congress specifically authorizes a higher maximum distribution amount for a specific Federal Disaster, which is within their power to do.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.