Big FAFSA Calculation & Application Changes Starting in 2023

Parents that are used to completing the FAFSA application for their children are in for a few big surprises starting in 2023. Not only is the FAFSA application being completely revamped but the FAFSA calculation itself is being changed which could result in substantially lower financial aid awards for many college-bound students.

Parents that are used to completing the FAFSA application for their children are in for a few big surprises starting in 2023. Not only is the FAFSA application being completely revamped but the FAFSA calculation itself is being changed which could result in substantially lower financial aid awards for many college-bound students.

FAFSA Application Delayed Until December 1st

In 2023, the FAFSA application will not become available for completion until December 1st. Normally the FAFSA application becomes available for completion on October 1st of each year but due to the changes that are being made to the application, software updates, and staff training, they have delayed the release of the FAFSA application for the 2024 – 2025 school year to December 1, 2023. This will reduce the window to time that parents have to submit the FAFSA application in 2023 so advanced preparation is advised.

A Simplified FAFSA Application

Completing the FAFSA application can be a very frustrating process; tons of questions, unclear wording as to what information FAFSA is actually asking parents to report, and you have to spend a lot of time collecting all of your personal financial documents that are needed to enter the information on the FAFSA application.

Fortunately, in 2020, Congress passed the FAFSA Simplification Act which will greatly simplify the FAFSA application in 2023 and years going forward. The old FAFSA application contained 108 questions, the new FAFSA application is only expected to contain 36 questions. In addition to cutting the questions in half, the wording of many of the questions will be amended to make it easier to understand how to report your financial assets. Two very welcome changes to the application.

EFC (Expected Family Contribution) Calculation Removed

In the past, completing the FAFSA application has resulted in an Expected Family Contribution (EFC) amount which is meant to provide a ballpark amount that a family may have to pay out of pocket before need-based financial aid is awarded to a student. The term EFC can be misleading because it’s not necessarily the hard dollar amount that parents will be required to pay out of pocket but rather it’s the family’s financial need relative to other applicants.

To remove this confusion, EFC will now be replaced by SAI (Student Aid Index), so now after parents complete the FAFSA application, it will result in an SAI amount.

Financial Aid Awards Reduced For Multiple Children

Parents that have multiple children in college at the same time may be in for an unfortunate surprise when they see the results of the new SAI calculation. In the past, if a parent completed the FAFSA application and it resulted in an EFC of $30,000, but they had two children in college at the same time, FAFSA would split the $30,000 between the two children, $15,000 each, which would potentially make each student eligible for a higher financial aid award.

Starting the 2024 – 2025 school year, FAFSA will no longer be providing this EFC (SAI) split for multiple children in college. If the FAFSA calculation results in a $30,000 SAI, that $30,000 will now apply to EACH student, instead of being split equally between each child, which could result in lower need-based financial aid awards going forward.

Divorced Parents FAFSA Calculation Change

When parents are divorced, and they have a child attending college, the custodial parent is the parent that submits the FAFSA application based on their income and assets. Historically, the FAFSA definition of the “custodial parent” was the parent that the child lived with for the majority of the 12-month period ending on the day the FAFSA application is filed. This often times created a very favorable financial aid award if the child was living for a majority of the year with the parent that had lower income and assets.

In 2023, for the 2024 – 2025 school year and years going forward, this is changing. The new FAFSA rules require the parent who provided the most financial support in the “prior-prior” tax year to complete the FAFSA application instead of the custodial parent. Prior-prior refers to the tax year 2 years ago from the beginning of the college semester. For the 2024 – 2025 award year, FAFSA would be looking at the 2022 tax year for this determination.

For example, Joe and Sue got divorced 5 years ago, and their daughter Mary is currently a sophomore in college. Sue is a homemaker, Mary lives with her mother for the majority of the year, Joe makes $300,000 per year, and pays Sue $25,000 per year in child support and $40,000 per year in alimony. For the 2023 – 2024, under the old FAFSA calculation, Sue was considered the custodial parent, and completed the FAFSA form using her annual income and assets. Since Joe is not the custodial parent, Joe’s income and assets are ignored for purposes of FAFSA.

For the 2024 – 2025 school year, under the new rules, that would now change. Since Joe is providing a majority of the financial support via child support and alimony payments, Joe would now be the parent required to submit the FAFSA application based on his income and assets. Since Joe’s income is substantially higher than Sue’s, it could result in a much lower college financial aid award.

There has been some initial guidance, that if there is a “tie” as to which parent provided the majority of the financial support, the ties are broken based on whichever parent has the higher adjusted gross income.

Changes to Pell Grants

One of the largest sources of need-based financial aid from the federal government is awarded via Pell Grants. For the 2024 – 2025 school year, the maximum Pell Grant amount has been increased but they have changed how the Pell Grant is calculated. The Pell Grant takes into account both the SAI result (new EFC) and the applicant’s adjusted gross income. Since the calculation of the SAI has changed, for reasons that we have already discussed, it could impact the amount of the Pell Grants awarded to students.

As a new benefit, parents will now be able to determine if their child will be eligible for a Pell Grant award based on income and family size before they even complete the FAFSA form.

Grandparent 529 Penalty Removed

A positive change that they made was eliminating the restriction associated with distributing money from a 529 account owned by a grandparent for the benefit of the grandchild. Previously, if distributions were made from a grandparent owned 529 accounts, those distributions were considered “income of the student” in the FAFSA calculation, which could dramatically reduce the financial aid awards in future years. The new legislation removed this restriction and made grandparent owned 529 accounts even more valuable than they were prior to this change.

Income Protection Allowance Increased

The FAFSA calculation has income thresholds that exclude specific amounts of income of both the parents and the child in the calculation of the Student Aid Index. Those income exclusion allowances have been increased starting in the 2024 – 2025 school year. For example, the income allowance for students for the 2023 – 2024 school year was $7,040, meaning a student could earn up to $7,040 without their income factoring into the FAFSA calculation. For the 2024 – 2025 school year, the student income allowance will be $9,410.

The income protection allowance for parents will be increased by about 20%.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Understanding FAFSA & How To Qualify For More College Financial Aid

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students

As the cost of college continues to rise, so does the financial stress that it puts on families trying to determine the optimal solution to pay for college. It’s never been more important for parents and family members of these students to understand:

How is college financial aid calculated?

Are there ways to increase the amount of financial aid you can receive?

What are the income and asset thresholds where financial aid evaporates?

Understanding the FAFSA 2 Year Lookback Rule

The difference between financial aid at public colleges vs private colleges

In this article we will provide you with guidance on these topics as well as introduce strategies that we as financial planners use with our clients to help them qualify for more financial aid.

How is college financial aid calculated?

Too often we see families jump to the incorrect assumption that “I make too much to qualify for financial aid.” Depending on what your asset and income picture looks like there may be strategies that will allow you to shift assets around during the financial aid determination years to qualify for need based financial aid. But you first need to understand how need based financial aid is calculated.

The Department of Education has a formula to calculate your “Expected Family Contribution” (EFC). The Expected Family Contribution is the amount that a family is expected to pay out of pocket each year before financial aid is awarded. Here is the general formula for financial aid:

It’s pretty simple and straight forward. Cost of the college, minus the EFC, equals the amount of your financial aid award. Now let’s breakdown how the EFC is calculated

Expected Family Contribution (EFC) Calculation

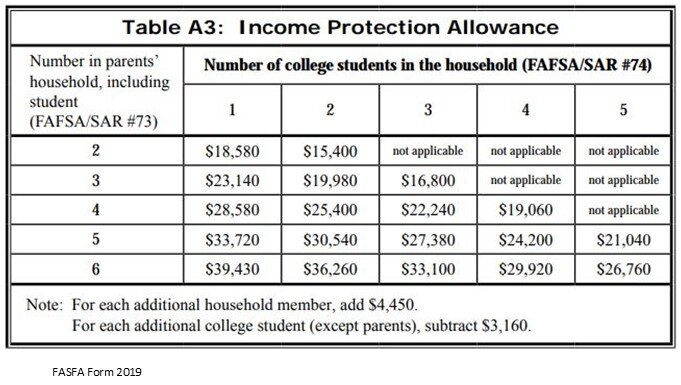

Both the parent’s income and assets, as well as the student’s income and assets come into play when calculating a family’s EFC. But they are weighted differently in the formula. Let’s look at the parent’s income and assets first.

Parent’s Income & Assets

Parents Income: The parent’s income is one of the largest factors in the EFC calculation. The percentage of the parents income that counts toward the EFC calculation is expressed as a range between 22% - 47% because it depends on a number of factors such as household size and the number of children that you have attending college at the same time.

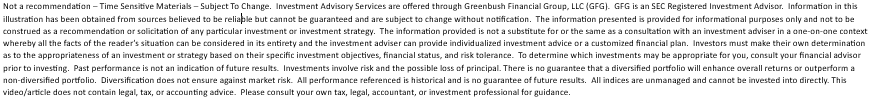

However, there is an “Income Protection Allowance” that allows parents to shelter a portion of their income from the formula based on the household size and the number of children attending college. See that chart below for the 2019-2020 FAFSA form:

Parents Assets: Any assets owned by the parents of the student are multiplied by 5.64% and that amount counts towards the EFC. Here are a few assets that are specifically EXCLUDED from this calculation:

Retirement Accounts: 401(k), 403(b), IRA’s, SEP, Simple

Pensions

Primary Residence

Family controlled business (less than 100 employees and 51%+ ownership by parents)

On the opposite side of that coin, here is a list of some assets that are specifically INCLUDED in the calculation:

Balance in 529 accounts

Real estate other than the primary residence

Even if held in an LLC – Reported separately from “business assets”

Non-retirement investment accounts, savings account, CD’s

Trusts where the student is a beneficiary of the trust (even if not entitled to distributions yet)

Business interest (less than 51% family owned by parents or more than 100 employees)

Similar to the Income Allowance Table, there is also a Parents’ Asset Protection Allowance Table that allows them to shelter a portion of their countable assets from the EFC formula. See the table below for the 2019-2020 school year.

Student’s Income & Assets

Now let’s switch gears over to the student side of the EFC formula. The income and the assets of the student are weighted differently than the parent’s income and assets. Here is the student side of the EFC formula:

As you can clearly see, income and assets in the student’s name compared to the parent name will dramatically increase the Expected Family Contribution and in turn decrease the amount of financial aid awarded. It is because of this, that as a general rule, if you think your asset and income picture may qualify you for financial aid, do not put assets in the name of your child. The most common error that we see people make are assets in an UGMA or UTMA account. Even though parents control those accounts, they are technically considered an asset of the child. If there is $30,000 sitting in an UTMA account for the student, they are automatically losing around $6,000 EACH YEAR in financial aid. Multiply that by 4 years of college, it ends up costing the family $24,000 out of pocket that otherwise could have been covered by financial aid.

EFC Formula Illustration

If we put all of the pieces together, here is an illustration of the full EFC Formula:

Grandparent Owned 529 Plans For The Student

As you will see in the EFC formula above, assets owned by the grandparents with the student listed as the beneficiary, like 529 accounts, are not counted at all toward the EFC calculation. This can be a very valuable college savings strategy for families since the parent owned 529 accounts count toward the Expected Family Contribution. However, there are some pitfalls and common mistakes that we have seen people make with regard to grandparent owned 529 accounts. See the article below for more information specific to this topic:

Article: Common Mistakes With Grandparent Owned 529 Accounts

Financial Aid Chart

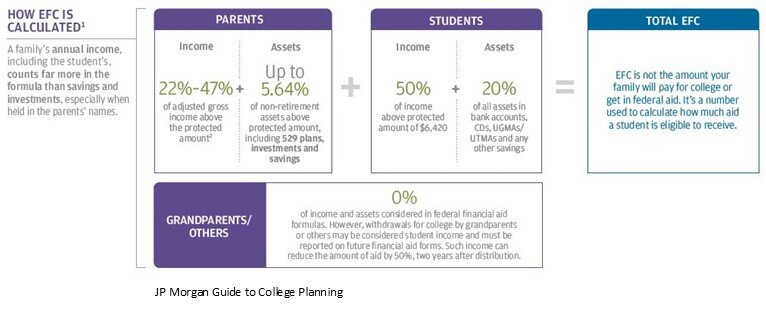

Our friends over at JP Morgan were kind enough to put a summary chart together for this EFC calculation which allows families to get a ballpark idea of what their Expected Family Contribution might be without getting out a calculator. The chart below is based on the following assumptions:

Two parent household

2 Children: One attending college and the other still at home

The child attending college has no assets or income

The oldest parent is age 49

Using the chart above, if the parents combined income is $150,000 and they have $100,000 in countable assets, the Expected Family Contribution would be $33,737 for that school year. What does that mean? If the student is attending a state college and the tuition with room and board is $26,000, since the EFC is greater than the total cost of college for that year, that family would receive no financial aid. However, if that student applies to a private school and the CSS Profile form results in approximately that same EFC of $33,737 but the private school costs $60,000 per year, then the family may receive need based financial aid or a grant from the private school equaling $26,263 per year.

Public Colleges vs. Private Colleges

It’s important to point out that FAFSA and the EFC calculation primarily applies to students that plan on attending a Community College, State College, or certain Private Colleges. Since Private Colleges do not receive federal financial aid they do not have to adhere to the EFC calculation that is used by FAFSA. Private college can choose to use to FAFSA criteria but many of the private colleges will require students to complete both the FAFSA form and the CSS Profile Form.

Here are a few examples of how the financial reporting deviates:

If the parents have a 100% family owned business, they would not have to list that as an asset on the FAFSA application but they would have to list the business as an assets on the CSS Profile form.

The equity in your primary residence is not counted as an asset for FAFSA but it is listed as an asset on the CSS Profile Form.

For parents that are divorced. FAFSA only looks at the assets and income of the custodial parent. The CSS Profile Form captures the assets and income of both the custodial and non-custodial parent.

Because of the deviations between the FAFSA application and the CSS Profile Form, we have seen situations where a student received no need based financial aid when applying to a $50,000 per year private school but they received financial aid for attending a state school even though the annual cost to attend the state school was half the cost of the private school.

Top 10 Ways To Increase College Financial Aid

Here is a quick list of the top strategies that we use to help families to qualify for more financial aid.

Disclosure: There are details associated with each strategy listed below that need to be executed correctly in order for the strategy to have a positive impact on the EFC calculation. Not all strategies will work depending on the financial circumstances of each household and where the child plans to attend college. Contact us for details.

Get assets out of the name of the student

Grandparent owned 529 accounts

Use countable assets of the parents to pay down debt

Move UTGMA & UGMA accounts to 529 UGMA or 529 UTMA accounts

Increase contributions to retirement accounts

Minimize distributions from retirement accounts

Minimize capital gain and dividend income

Accelerate necessary expenses

Use home equity line of credit instead of home equity loan

Families that own small businesses have a lot of advanced planning options

FAFSA – 2 Year Lookback

It’s important to understand the FAFSA application process because you have know when they take the snapshot of your income and assets for the EFC calculation in order to have a shot at increasing the financial aid that you may be able to qualify for.

FAFSA looks back 2 years to determine what your income will be for the upcoming school year. For example, if your child is going to be a freshman in college in the fall of 2020, you will report your 2018 income on the FAFSA application. This is important because you have to start putting some of these strategies into place in the spring of your child’s sophomore year in high school otherwise you could miss out on planning opportunities for their freshman year in college.

If your child is already a junior or senior in high school and you are just reading this article now, there is still an opportunity to implement some of the strategies listed above. Income has a 2 year lookback but assets are reported as of the day of the application. Also the FAFSA application is completed each year that your child is attending college, so even though you may have missed income reduction strategies for their freshman year, at some point the 2 year lookback will influence the financial aid picture during the four years of their undergraduate degree.

IMPORTANT NOTE: Income has a 2-year lookback

Asset balances are determined on the day that you submit the FAFSA Application

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.