Do I Make Too Much To Qualify For Financial Aid?

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment.

If you have children that are college-bound at some point you will begin the painful process of calculating how much college will cost for both you and them. However, you might be less worried about the financial aspects of your child going to college after viewing some of the Bloomsburg student apartments for rent on the market at the moment. Anyway, I have heard the statement, "well they will just have to take loans" but what parents don't realize is loans are a form of financial aid. Loans are not a given. Whether your children plan to attend a public college or private college, both have formulas to determine how much a family is expected to pay out of pocket before you even reach any "financial aid" which includes loans.

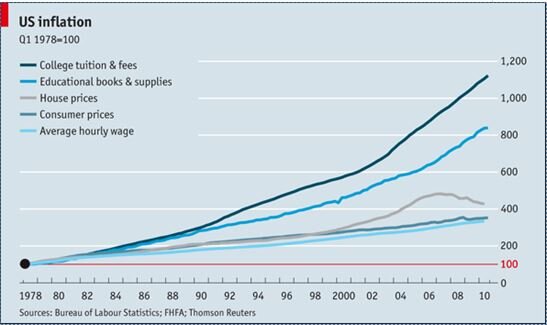

College Costs Are Increasing By 6.5% Per Year

The rise in the cost of college has outpaced the inflation rate of most other household costs over the past three decades.

To put this in perspective, if you have a 3 year old child and the cost of tuition / room & board for a state school is currently $25,000 by the time that child turns 17, the cost for one year of tuition / room & board will be $60,372. Multiply that by 4 years for a bachelor's degree: $241,488. Ouch!!! Which leads you to the next question, how much of that $60,372 per year will I have to pay out of pocket?

FAFSA vs CSS Profile Form

Public schools and private school have a different calculation for how much “aid” you qualify for. Public or state schools go by the FAFSA standards. Private schools use the “CSS Profile” form. The FAFSA form is fairly straight forward and is applied universally for state colleges. However, private schools are not required to follow the FAFSA financial aid guidelines which is why they have the separate CSS Profile form. By comparison the CSS profile form requests more financial information.

For example, for couples that are divorced, the FAFSA form only takes into consideration the income and assets of the parent that the child lives with for more than six months out of the year. This excludes the income and assets of the parent that the child does not live with for the majority of the year which could have a positive impact on the financial aid calculation. However, the CSS profile form, for children with divorced parents, requests and takes into consideration the income and assets of both parents regardless of their marital status.

Expected Family Contribution

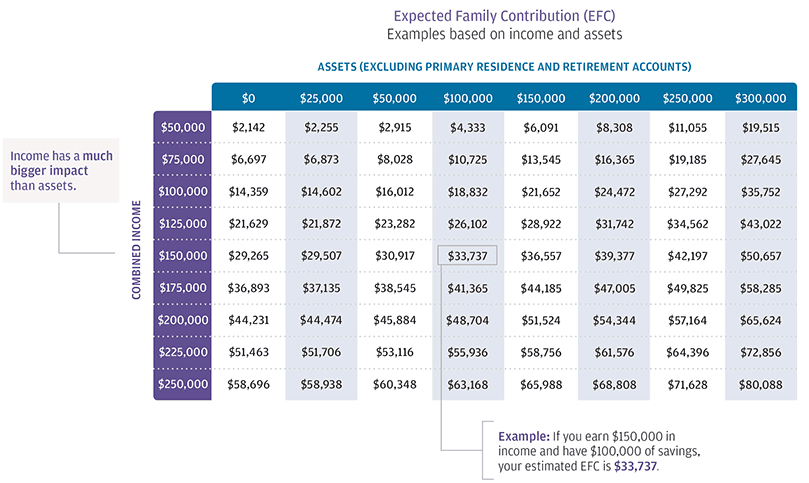

Both the FAFSA and CSS Profile form result in an "Expected Family Contribution" (EFC). That is the amount the family is expected to pay out of pocket for their child's college expense before the financial aid package begins. Below is a EFC award chart based on the following criteria:

FAFSA Criteria

2 Parent Household

1 Child Attending College

1 Child At Home

State of Residence: NY

Oldest Parent: 49 year old

As you can see in the chart, income has the largest impact on the amount of financial aid. If a married couple has $150,000 in AGI but has no assets, their EFC is already $29,265. For example, if tuition / room and board is $25,000 for SUNY Albany that means they would receive no financial aid.

Student Loans Are A Form Of Financial Aid

Most parents don't realize the federal student loans are considered "financial aid". While "grant" money is truly "free money" from the government to pay for college, federal loans make up about 32% of the financial aid packages for the 2016 – 2017 school year. See the chart below:

Start Planning Now

The cost of college is increasing and the amount of financial aid is declining. According to The College Board, between 2010 – 2016, federal financial aid declined by 25% while tuition and fees increased by 13% at four-year public colleges and 12% at private colleges. This unfortunate trend now requires parents to start running estimated EFC calculation when their children are still in elementary school so there is a plan for paying for the college costs not covered by financial aid.

About Michael.........

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Common Mistakes With Grandparent Owned 529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are

529 Accounts

529 college savings accounts owned by the grandparents can be in a valuable benefit for a college bound grandchild. Since the accounts are owned by the grandparents it does not show up anywhere for financial aid purposes which allows the student to qualify for more financial aid. However, even though 529 account owned by the grandparents are not considered an asset when applying for financial aid, distributions from 529 accounts on behalf of the beneficiary are considered income of the account beneficiary in the year that the disbursement occurs from 529 account.

For example, assume the grandchild receives $20,000 in financial aid in their freshman year but there is still a $10,000 balance due to attend college. The grandparents distribute $10,000 from the 529 account that they own for the benefit of the grandchild. When the parents apply for the financial aid package in the student’s Junior year, they $10,000 529 disbursement that took place in the freshman year will need to be reports as income of the student on the FASFA application. That could completely destroy their financial aid package since 50% of the student’s income counts against the financial aid package.

Remember, the FASFA application now looks back two years instead of one for income purposes. To avoid this situation, the grandparents should not distribute any money from the grandchild’s 529 account until the spring semester of their sophomore year.

Don’t setup UGMA or UTMA accounts

UGMA a stands for Uniform Gift to Minors Act. UTMA stands for Uniform Transfer to Minors Act. Different names but the accounts work in a similar fashion.

If there is a chance that the student may qualify for financial support from either a public or private institution, these accounts can significantly reduce the financial award. The types of accounts are considered an asset of the child not the grandparent. When an asset is titled in the child’s name, approximately 20% of the account balance will count against their financial aid package. For this reason, it is often more beneficial to establish a 529 account which is considered an asset of the grandparent and can be invisible for financial aid purposes.

About Michael……...

Hi, I’m Michael Ruger. I’m the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.

Need to Know College Savings Strategies

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control.

Our newsletter this quarter is dedicated to helping families plan for what has become a life-altering cost of paying for college. But do not fear, there are simple things you can do to boost your children's college fund. It is not news to anyone that over the past 30 years, the cost of college tuition and room & board at all levels has spun out of control. The year over year increase in the cost of tuition and fees since 1978 to date has far outpaced any reasonable rate of inflation, and demands a new look at college savings strategies. In the chart below, you will see the increase in the price of college tuition and fee versus other comparable expenses over the past 30 years. Its mind blowing!!

Fund A 529 Account*

As far as college savings strategies go, there are very few options that beat 529 accounts as a savings vehicle for college. In these accounts you make after tax contribution to the account and when the amounts are withdrawn, as long as those withdrawals are attributed to a qualified college expenses, the earnings generated by the account are tax free. Depending on the state you live in you may be eligible to receive a state tax deduction for contribution up to specified dollar amount. In New York, single filers receive a NYS tax deduction up to $5,000 and married filing joint $10,000.

Also for financial aid purposes these account are looked at very favorably in the EFC (Expected Family Contribution) calculation. They are looked at by FASFA as an asset of the "parent" not the asset of the "child". There are many contribution and withdrawal strategies associated with these accounts that can produce big tax benefits for individuals accumulating savings for themselves or their children.

Roth IRAs Are Not Just For Retirement

When clients have the dual goal of saving for retirement and saving for college, the Roth IRA is often times a great option. Even if you make too much to contribute directly to a Roth, you can implement a "non-deductible IRA to Roth IRA conversion strategy" that will allow you to still get money into a Roth IRA.

Contributions to Roth IRAs are made with after tax dollars but unlike a traditional IRA if you hold a Roth IRA for at least 5 years and make withdrawals after age 59 1/2 you pay no tax on the earnings.

Here is one college savings strategy technique: You are allowed at any time and at any age to withdrawal the contribution portion of your account balance from a Roth IRA tax and penalty free. For example, if I contribute $5,000 to a Roth IRA and 5 years later it is worth $10,000, I can contact my IRA provider and request that they distribute just my basis ($5,000) and leave the earnings in the account to continue to accumulate tax free. You can then use that basis distribution to fund college expenses but the earnings in the Roth IRA continue to accumulate tax free.

Maximize Your Financial Aid

There are strategies that can be implemented leading up to the filing of the FASFA form that can increase that amount of financial aid that you receive. When you apply for financial aid, FASFA has a complex EFC calculation that takes a snapshot of your assets and income to determine how much financial aid you will qualify for. There are ways to shift assets and shelter income from this calculation that can save individuals and families thousands of dollars when it come to paying for college. Here are a few of the strategies that can help to improve a EFC calculation:

Save money in the parents or grandparents name, not the childs name

Pay off consumer debt, such as credit cards and auto loans

Spend down the students asset and income first

Accelerate necessary expenses (such as computer purchase) to reduce cash

Minimize capital gains

Maximize your contributions to a retirement plan

Do not withdrawal money from a retirement plan to pay for college

Ask grandparents to wait to give grandchildren money until after college

Trust funds are generally ineffective at sheltering money from EFC

Prepay your mortgage

Contribute to 529 plans owned by the parent or grandparent

Choose the date to submit the FASFA carefully

About Michael...

Hi, Im Michael Ruger. Im the managing partner of Greenbush Financial Group and the creator of the nationally recognized Money Smart Board blog . I created the blog because there are a lot of events in life that require important financial decisions. The goal is to help our readers avoid big financial missteps, discover financial solutions that they were not aware of, and to optimize their financial future.